Understanding Forex Trading Regulations: A Comprehensive Guide

Forex trading has revolutionized the financial landscape, offering traders the opportunity to engage in a global marketplace 24/5. However, with great opportunity comes great responsibility, particularly regarding regulations that govern the forex markets. Ensuring compliance with forex trading regulations Forex Trading Apps, protecting investors, and maintaining the integrity of the market are priorities for regulatory bodies worldwide.

The Importance of Forex Trading Regulations

Forex trading regulations are essential for several reasons:

- Investor Protection: Regulations are primarily designed to protect investors from fraudulent activities and ensure their capital is safeguarded.

- Market Integrity: By establishing a framework for trading practices, regulations help maintain fair trading conditions and market integrity.

- Confidence in the Market: A well-regulated market fosters confidence among retail and institutional traders, encouraging participation and liquidity.

- Prevention of Market Manipulation: Regulations are in place to deter and punish manipulative practices, preserving the ethical standards of trading.

Key Regulatory Bodies in Forex Trading

Understanding the regulations can be complex due to the involvement of multiple regulatory bodies across different jurisdictions. Here are some of the most significant ones:

1. Commodity Futures Trading Commission (CFTC)

The CFTC is a U.S. government agency responsible for regulating the U.S. derivatives markets, including forex. Established in 1974, the CFTC aims to protect market participants from fraud, manipulation, and abusive practices.

2. National Futures Association (NFA)

As a self-regulatory organization for the U.S. derivatives market, the NFA oversees forex brokers and provides a range of services, including registration and compliance. It is crucial for retail forex traders to choose a broker that is a member of the NFA.

3. Financial Conduct Authority (FCA)

The FCA regulates the financial markets in the UK, including forex trading. By providing oversight and enforcement of compliance, the FCA ensures that firms operate fairly and in the best interests of clients.

4. Australian Securities and Investments Commission (ASIC)

As Australia’s corporate regulator, ASIC plays a similar role by overseeing financial services and markets, ensuring that investors are treated fairly and that the integrity of the market is maintained.

5. Cyprus Securities and Exchange Commission (CySEC)

CySEC is the financial regulatory agency of Cyprus and is becoming increasingly important in the forex market. Many brokers choose to be regulated in Cyprus due to the favorable regulatory framework for forex trading.

Global Perspective on Forex Regulations

Forex regulations vary greatly from one jurisdiction to another. Traders must familiarize themselves with the regulatory environment in the countries they trade from or where their brokers are located. While regulation aims to protect traders, differences in rules and enforcement can create challenges. Here are several points to consider:

1. Different Levels of Regulation

Not all jurisdictions impose strict regulations on forex brokers. Some countries have lenient regulations, which may attract forex companies but can pose risks for traders. It’s important to verify where a broker’s regulations stand.

2. Global Legitimacy and Trust

Trading with a broker regulated by a reputable authority (like the FCA or CFTC) often instills more confidence than trading with a company in a less-regulated area. Traders should always check the regulatory status of their brokers.

3. Compliance Requirements

Each regulatory body has specific compliance requirements that brokers must meet. These can include capital reserves, regular reporting, conduct of business rules, and more – all aimed at protecting consumer interests.

How to Choose a Regulated Forex Broker

Selecting a regulated forex broker is crucial for ensuring your trading experience is safe and secure. Here are some tips for choosing the right broker:

1. Verify the Broker’s Regulatory Status

Before you start trading, ensure that your broker is properly regulated in the relevant jurisdiction. Consult the regulator’s website for a list of licensed firms.

2. Review Regulations and Requirements

Understand the specific regulations and requirements that apply to your broker’s jurisdiction. Look for brokers that adhere to strict guidelines related to client funds, reporting, and transparency.

3. Check Reviews and Feedback

Previous and current trader feedback can give insights into the broker’s reliability and customer service. Look for forums or reviews that discuss the experiences of other traders.

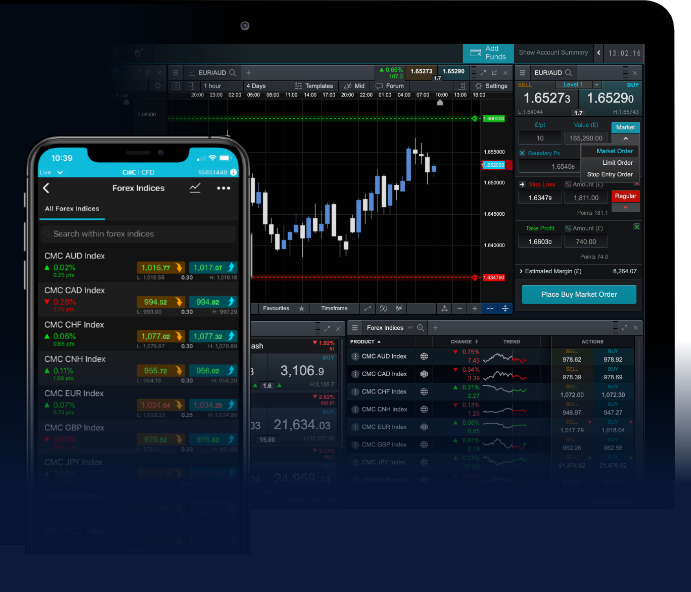

4. Assess Trading Platforms and Tools

Ensure that your broker offers a reliable trading platform that suits your trading style. Many brokers provide advanced tools, educational resources, and demo accounts for testing.

Conclusion

Forex trading regulations play a significant role in shaping a secure and reliable trading environment. Traders must understand the regulatory landscape and choose brokers that comply with relevant regulations. While navigating the complexities of forex regulations may seem daunting, it is essential to prioritize safety and compliance, ensuring a robust trading experience. By being informed and vigilant, traders can enjoy the opportunities available in the forex market while minimizing potential risks.

No Comment