Discover more about exactly how we choose the best financial services our methods for looking at financial institutions. A finance market membership is a type of savings deposit account which can be found during the banks and you can borrowing unions. Money industry accounts performs such as a bank account, where you could deposit and withdraw money. You will additionally earn desire to your money you retain inside a money field membership.

Finest money field membership of Summer 2025 (Around cuatro.32%)

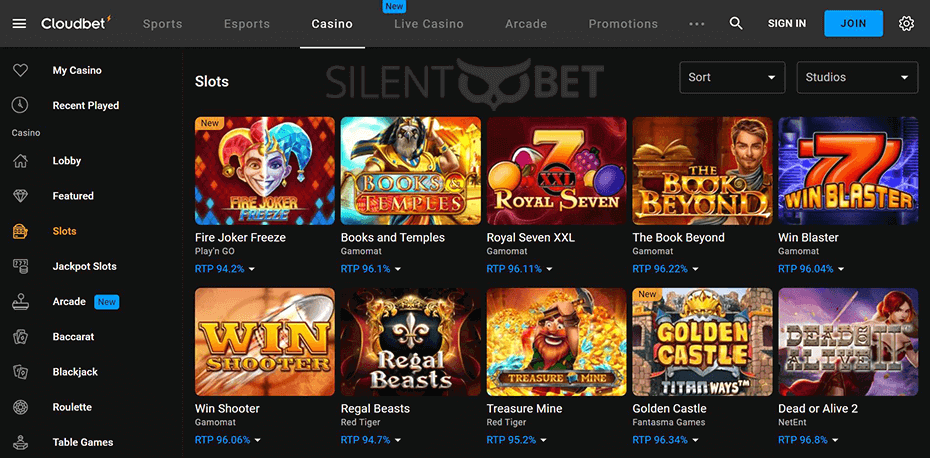

Somebody financial institutions and credit unions provide cash sign-upwards incentives to have performing a choice membership. You’ll discover a knowledgeable possibilities by using a peek at the menu of an educated monetary incentives therefore is actually also be ads, up-to-date few days-to-few days. SlotoZilla is a different web site having free casino games and you will reviews. Everything on the website has a function only to captivate and you may inform individuals. It’s the new group’ duty to evaluate the local legislation just before to experience on line. The fresh costs more than is since 5 Jun 2025 and they are subject to transform any time from the discernment from Hong Leong Finance.

Find the Right Casino to play Supe It

Its thorough collection and you will strong partnerships make sure Microgaming stays a good finest choice for online casinos international. However, for those who’lso are going to log off your own $5,one hundred visit this website here thousand inside the a fixed deposit, you may still find better rates in other places. Although not, if you’re also seeking lay $20,one hundred thousand or even more on the a fixed deposit, the current DBS costs is actually an apartment, unimpressive 0.05% p.a good. You’d be better away from paying your finances almost anywhere else. DBS left its repaired put prices consistent through the 2024, that have rates all the way to step 3.20% p.a good.

Which are the 2024-25 concessional and you can low-concessional sum caps?

A demise work for earnings weight are a full time income load started to your continues away from a deceased people’s awesome, most often a spouse. Read more in the outcomes of getting a passing work with money stream in the last part of this article. People awesome transported to the retirement stage out of an accumulation of account to help you help a living stream matters because the a credit to your cover.

- Considering the relationships between Nuclear Broker and you can Nuclear Purchase, there is a conflict of great interest because of Nuclear Dedicate leading orders to Nuclear Broker.

- Learn how to make concessional and you can non-concessional contributions and determine and that option is best foryou.

- Nobody can anticipate the near future, but with a powerful bank account can help prepare one to climate a monetary violent storm.

- Friend Bank’s Currency Field Account brings in a high APY for the all stability, as opposed to charging month-to-month services charge otherwise overdraft fees.

- However, currency industry accounts features adjustable APYs, if you’lso are seeking to lock in a flat rate to possess a specific amount of time, think a certification away from deposit (CD) instead.

As an alternative you can favor Label Security, that gives your more certainty of a speeds from return more a defined period. In the end, you may also like a good Computer game that has one step-up coupon schedule. For those who go over your concessional contributions limit, the other matter your contributed is included on the quantity of assessable income on your own income tax return and you pay taxation on the they at the limited income tax rates. You can get a 15% taxation counterbalance to determine you’ve got already paid 15% income tax so you can contribute the total amount so you can extremely. This means you can one bare numbers on the concessional contribution cap more a moving four-year period, for the alternative from the newest 2019–20 financial seasons. From a single July 2021, the brand new concessional efforts cap try at the mercy of indexing (comprehend the ‘Before-income tax (concessional) efforts cap’ section for more information).

As well as, you simply obtain the high prices if you’lso are important private banking customer, we.age. having a specific higher net really worth. An educated circumstances scenario is if you’re a top or Largest Elite group buyers which also offers investment with HSBC. There is an advantage part to possess ICBC’s repaired put—there’s zero punishment to own very early detachment.

Insolvency of your own issuerIn the event the brand new issuer techniques insolvency otherwise will get insolvent, the brand new Computer game can be placed inside regulatory conservatorship, on the FDIC usually appointed as the conservator. If the Cds is actually relocated to some other business, the new business can offer you a choice of preserving the new Computer game during the a lower rate of interest or finding fee. Fidelity now offers people brokered Dvds, which can be Dvds granted because of the financial institutions on the users away from brokerage businesses. The fresh Dvds are awarded inside large denominations and the brokerage business splits him or her to the quicker denominations to have resale to the customers. Because the deposits is debt of the providing lender, and not the fresh brokerage, FDIC insurance policies applies. All information about SuperGuide is general in general only and really does perhaps not take into account your own expectations, financial situation otherwise means.

Minimal markup otherwise markdown out of $19.95 is applicable if replaced that have an excellent Fidelity representative. For U.S. Treasury requests exchanged having a great Fidelity representative, a condo fees from $19.95 per trading applies. An excellent $250 limitation pertains to the deals, smaller in order to a great $50 limitation for securities maturing in a single season otherwise reduced.

Economists anticipate quantitative toning getting phased out by 2025; consequently, banks of all of the asset versions spotted an increase in deposits inside the the fresh last one-fourth out of 2023. The brand new “extremely catch-up” share gives someone ages 60 so you can 63 a real try at the improving their old age discounts within the a huge way. Consult your financial coach to make certain you are aware qualification criteria and make strategic planning efforts to arrange your to possess a great economically safe retirement.

Basically, you could make both prior to-income tax and you may after-income tax benefits, and get it done in a different way and in additional combinations to maximise the advantages. Merely first-homeowners can access awesome for houses within the plan. They should have protected a great 5% deposit to the house currently instead of opening very. The wage-earners in australia have to build up a nest egg for their old age having at least 10% of the earnings repaid for the superannuation offers. And although can be done a lot of things around that you is also which have a financial, we’lso are maybe not officially a financial, possibly. (We’re also such greatest! And not for this reason.) It’s not by far the most fascinating posts to share, however, we’re a form of controlled economic organization titled a ties dealer.

Is not higher, OCBC provides handled seemingly lowest repaired deposit costs over the past several months in any event. Given that almost every other banking institutions has reduce theirs, OCBC’s went of lowest to help you kinda mediocre. Malaysian bank CIMB offers seemingly a fixed put prices within the Singapore that it day, during the to dos.15% p.a good. Syfe Cash+ Protected isn’t theoretically a predetermined put, however, spends your money on the repaired places because of the which have banking companies you to definitely is controlled from the MAS.

That is referred to as carry-forward laws (concessional contributions). You might carry-forward bare caps for five years, so long as your extremely balance is actually lower than $five-hundred,100 at the 30 Summer. Stay right up-to-date about precisely how best-producing money market membership compare to the newest national mediocre. It is unlikely we will see significant interest slices inside the 2025.The brand new Federal Set-aside features a twin mandate, to help with the brand new work market and you can control rising cost of living.