Understanding Competitive Exness Fees

When considering a trading platform, one of the most critical factors to examine is the fee structure. In the realm of online trading, Competitive Exness Fees https://qtechub.ca/tipo-de-cuenta-exness-28/ has carved out a niche for itself by providing competitive fees tailored for both beginners and seasoned traders. Understanding these fees is essential for optimizing trading strategies and overall profitability.

Types of Fees Associated with Exness

Exness operates with several types of fees that traders should be aware of:

- Spreads: This is the difference between the buying (ask) and selling (bid) price. Exness offers variable spreads that can be as low as 0.0 pips, depending on the account type and market conditions.

- Commission Fees: For certain account types, Exness charges commissions on trades. The fee depends on the trading volume and the account specification.

- Overnight Fees: Also known as swap fees, these are incurred when positions are held overnight. The rates depend on the asset and its associated interest rates.

- Withdrawal Fees: While Exness does not charge for most deposit methods, they may have fees for certain withdrawal options, which traders should check before moving funds.

Breaking Down Spreads

Spreads play a significant role in determining the overall cost of trading on Exness. The platform offers two types of accounts: Standard and Raw Spread accounts, each with distinct spread characteristics.

- Standard Account: This option is suitable for beginners, featuring relatively higher spreads but no commission fees. The spreads vary by asset and market volatility.

- Raw Spread Account: Aimed at professional traders, this account features tighter spreads starting at 0.0 pips paired with a low commission fee, making it favorable for high-frequency trading strategies.

It is vital to understand the type of account that aligns with your trading strategy to minimize costs.

Commission Fees Explained

The commission fees imposed by Exness can add up, especially for traders dealing in large volumes. They are charged per lot traded, and understanding these fees can significantly impact profit margins. For instance, the commission rate for a Raw Spread account may differ based on the balance and trading activity, thus necessitating careful consideration for frequent traders.

Managing Overnight Fees

Playing the overnight market can be advantageous yet costly due to swap rates. These rates are calculated based on interest rate differentials between the currencies traded. Exness provides a transparent breakdown of these overnight fees, allowing traders to make informed decisions about holding positions overnight or closing them before the trading day ends.

Withdrawal Fees and Options

Withdrawing funds from Exness is generally hassle-free, with multiple options available. However, it’s crucial to note that certain methods may incur withdrawal fees. Users are encouraged to choose the most cost-effective withdrawal method and keep abreast of any potential fees that might apply based on the chosen options.

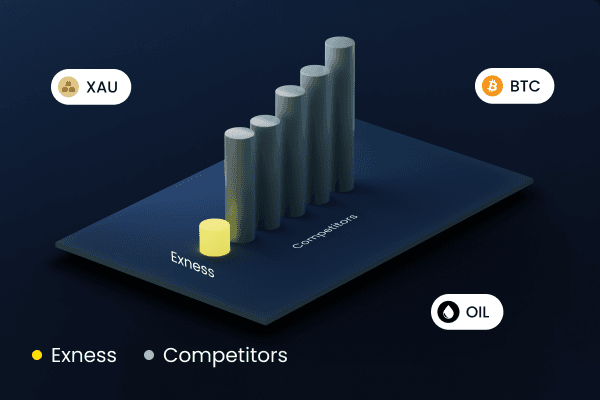

Competitive Analysis: How Exness Stacks Up

In the competitive landscape of forex trading platforms, Exness stands out for its transparent fee structures. When comparing with other brokerages, Exness’s fees tend to be lower, making it an attractive option for both new and experienced traders. Platforms like IC Markets and FP Markets also feature competitive fees, but Exness offers unique advantages, particularly in the form of lower deposit requirements and efficient trade execution times.

Conclusion

In summary, understanding Competitive Exness Fees is essential for traders who aim to maximize their returns in the forex market. By analyzing spreads, commission structures, overnight fees, and withdrawal options, traders can make educated decisions that align with their financial goals. Given the rich landscape of trading platforms available today, Exness’s commitment to competitive pricing distinguishes it as a broker worth considering for anyone serious about trading.

No Comment