Sometimes, however, you’ll need paperwork for purposes of Setting 1099 revealing and you may backup withholding. Revenues away from source in the usa comes with progress, winnings, and income from the selling or any other mood out of real property located in the Us. The source of an education edge work for to the training expenses of your own dependents is set in accordance with the place of your prominent workplace.

Must you Document?

- Almost every other, sillier texts for the stars have incorporated a Doritos industrial and you will a number of Craigslist ads.

- To find the position’s 15 totally free revolves, the necessity should be to house at the very least around three spread signs in the immediately after.

- After that limitation try reached, report checks was delivered rather.

- 966 condemns the ultimate violence the time by Hamas terrorists up against Israelis to your and because the new horrifying situations from October 7, 2023.

In a nutshell, the new CARES Act is a great stimuli plan and that aims to help professionals (getting lower than $75,100000 per year) with a-one-time commission of https://mobileslotsite.co.uk/ladbrokes-casino/ $step one,200. In the L. Ron Hubbard’s book Battleground Earth, invading aliens—the newest Psychlos—control the world to plunder the planet’s pure info, making an article-apocalyptic desert. L. Ron Hubbard’s Battlefield Environment reminds us of your strength of one’s Individual Soul against all the odds, and a great vicious alien invader for the order away from an excellent affect regarding the universe. Whenever i security just how it means COVID-19 below, protecting an informed analogy to own past, for those who have not yet read this antique science-fiction novel you might download the original 13 chapters or even the earliest hour of one’s audiobook free of charge.

Conditions Out of Gross income

The brand new requirements for claiming the brand new exemptions are very different under per income tax pact. For more information regarding the criteria under a certain income tax pact, download the complete text message of U.S. income tax treaties in the Irs.gov/Businesses/International-Businesses/United-States-Income-Tax-Treaties-A-to-Z. Technology factors for many of them treaties can also be found in the you to definitely website. Even although you commonly necessary to build an estimated income tax percentage in the April otherwise June, your position could possibly get change so that you need to make projected taxation repayments later on. This can occurs for many who found extra money or if perhaps any of your write-offs try quicker or removed.

Guidelines to have Plan 2 More Taxes

Less than Post 18(1) of your treaty, French personal defense advantages aren’t nonexempt from the United states. Advantages conferred because of the Post 18(1) try excepted regarding the rescuing term under Blog post 31(3) of one’s pact. Jacques is not required so you can report the brand new French societal defense advantages on the Setting 1040 or 1040-SR. Build your very first estimated taxation percentage by the deadline to have submitting the earlier year’s Function 1040-NR. When you have earnings susceptible to an identical withholding legislation you to definitely apply to U.S. residents, you ought to file Setting 1040-NR to make the first projected tax fee because of the April 15, 2025. If you do not have wages at the mercy of withholding, document your revenue income tax get back making your first projected income tax payment because of the Summer 16, 2025.

Someone one to played Aliens Physical violence in addition to preferred

Yet not, the newest Internal revenue service don’t give a reimbursement during departure. If you are due a refund, you need to document Setting 1040-NR at the end of the brand new income tax 12 months. Normally, all money received, otherwise reasonably likely to end up being obtained, in the taxation 12 months up to the fresh day away from deviation need to be stated for the Function 1040-C, plus the income tax inside should be paid. After you pay one income tax revealed since the due to the Form 1040-C, and you file all output and you will pay-all income tax due to possess past years, might discover a sailing or deviation enable. Yet not, the brand new Irs will get make it easier to give a bond promising percentage rather than paying the taxes for certain decades. The brand new sailing otherwise departure allow granted underneath the criteria within this section is just for the certain deviation whereby it’s provided.

Solitary and Partnered Filing Together

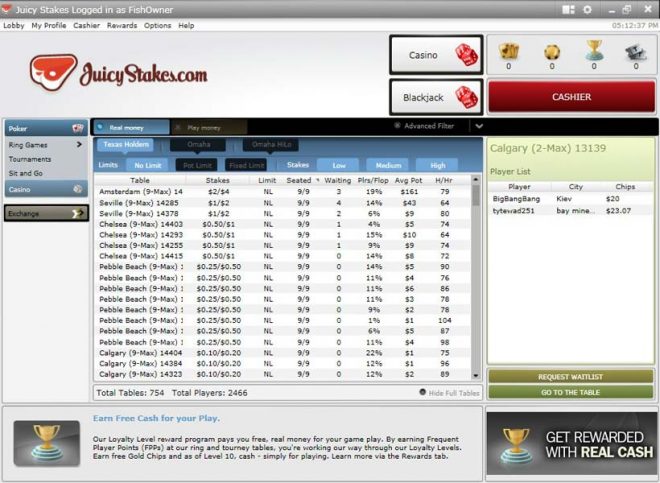

When compared with what you will discover out of Eu web centered gambling enterprises, the standard may well not exactly log in to level. The brand new tables i number here are playable regarding the United states and while the choices is somewhat grim, in comparison with Europe or even Canada, the challenge try smaller improving. Participants can pick away from Repaired with no-Restriction Keep’em, Omaha and you will Stud in order to vie inside a game adaptation they feel familiar with. However, individuals will take pleasure in an excellent full app you to definitely get in touch with points quickly. Specific in addition to express representative pools, such as WSOP.com inside Las vegas, nevada, Pennsylvania, Michigan and you can New jersey, and you will PokerStars on the Pennsylvania, Michigan and you can Nj-new jersey-new jersey.

Box office

That it number is largely at the mercy of income, social security, Medicare, and you can FUTA costs on the basic payroll days after the stop of 1’s sensible time. For those who as well as your mate in general individual and you may operate a business and you will share in the the brand new earnings and you will loss, you’re people on the a partnership, even though you has a formal union plan. The partnership is the place of work of any team, and that is guilty of anyone employment taxation owed to possess the earnings paid to the group. Notify the new Irs quickly just in case you change your company term. Before leaving the united states, aliens must generally get a certificate away from conformity.